Moratorium for NHT Mortgagors

The Hurricane Relief Moratorium is a temporary suspension of mortgage payments for mortgagors affected by the Hurricane.

Key Details:

Eligible mortgagors are those with properties in the following seven (7) parishes:

- Manchester

- Westmoreland

- St. James

- St. Ann

- St. Elizabeth

- Hanover

- Trelawny

- Duration: 6 months (November 2025 – April 2026)

- Mortgagor accounts will be automatically adjusted to reflect the moratorium

Mortgagors in other parishes whose properties were damaged may also apply for a moratorium of up to six months. These applications will be considered on a case by cases basis.

Apply Now

Completed forms should be submitted to specialassistance@nht.gov.jm.

Note: Applicants should ensure they have the necessary documentation, including proof of property ownership, evidence of damage, and current contributor information.

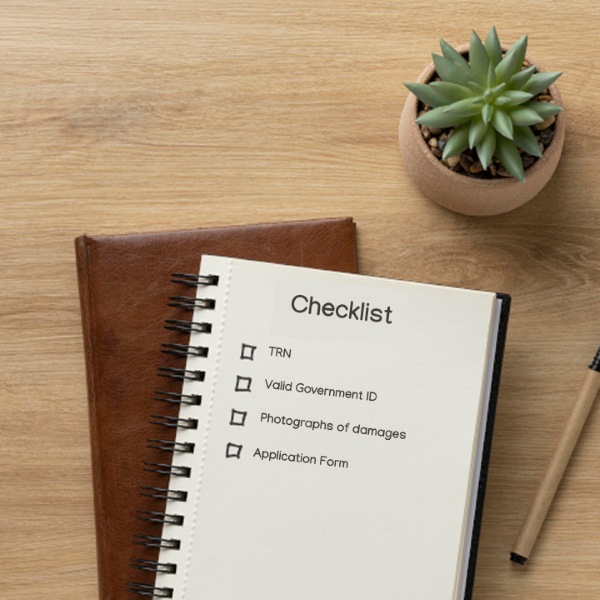

Relief Moratorium Checklist

The following documents should accompany your completed application form:

- Valid Government Issued Identification (Passport, Driver’s License or Voter’s Identification)

- TRN card or letter from TAJ

- Power of Attorney (applicable for individuals acting as an official representative for mortgagor(s))

- Photographs of damages to the mortgaged property caused by Hurricane Melissa (applicable to mortgagors whose properties were damaged)

- Completed Electronic Mail Indemnity Form which can be found on NHT’s website (for individuals who have not registered for electronic mail).

- Proof of reduced income (if applicable)

- Proof of unemployment (if applicable)

Additional Resources

Other helpful resources for Hurricane Melissa recovery

Hurricane Relief Loan

This special home improvement loan is designed to help homeowners finance repairs to properties damaged during the Hurricane.

Hurricane Relief Grant

Provides financial assistance to contributors who suffered property damage due to Hurricane Melissa.

Peril Insurance Claim

If your NHT mortgaged property suffered damage due to Hurricane Melissa, you may be eligible to submit a peril insurance claim.

Frequently Asked Questions (FAQs)

The Hurricane Relief Moratorium is the temporary suspension of all, or part of the required monthly mortgage payments to assist mortgagors who were adversely affected by the passage of Hurricane Melissa.

All mortgagors whose properties are located in the following seven (7) parishes are eligible. Their accounts will be automatically adjusted to reflect the moratorium:

- Manchester

- St. Elizabeth

- Westmoreland

- Hanover

- St. James

- Trelawny

- St. Ann

Yes, you may apply for the Hurricane Relief Moratorium if your property was damaged from the passage of Hurricane Melissa.

The steps outlined below are to be followed when applying for the special moratorium:

- Visit our website at www.nht.gov.jm and visit the disaster relief initiatives section. This will take you to the checklist and forms to be completed.

- Download and complete the application form.

Note: In Section 6, Question 1, under “other,” specify that you have been impacted by Hurricane Melissa and describe the damage to the property. Do not respond to Questions 3 to 8 in Section 6. Do not respond to Section 7. - Submit the completed form and supporting documents to specialassistance@nht.gov.jm

The following documents should accompany your completed application form:

- Valid Government Issued Identification (Passport, Driver’s License or Voter’s Identification)

- TRN card or letter from TAJ

- Power of Attorney (applicable for individuals acting as an official representative for mortgagor(s))

- Photographs of damages to the mortgaged property caused by Hurricane Melissa (applicable to mortgagors whose properties were damaged)

- Completed Electronic Mail Indemnity Form which can be found on NHT’s website (for individuals who had not registered for electronic mail).

- Proof of reduced income (if applicable):

- Proof of unemployment (if applicable):

The period of the moratorium is six (6) months. That is, November 2025 to April 2026.

Yes. Applications for the moratorium must be submitted by January 30, 2026.

Yes. While interest charges will be waived during the six-month moratorium period, your monthly mortgage payments may increase once the moratorium ends; as the loan will be rescheduled to account for the unpaid principal and insurance during the moratorium period.

Yes. If you carried out the repair work, you must present proof of damage and debris, as well as proof of monies spent for the repairs.

Yes, you can continue making payments while your account is in moratorium. If your account is not in arrears, these payments will be applied directly to your principal balance. This can help reduce your overall principal balance and may lower your monthly payments once the moratorium period ends.

No. Accessing the Hurricane Relief Moratorium does not reduce the maximum 24-months regular moratorium which you can benefit from over the life of the loan once the criteria are met.

- If you had overdue payments before the moratorium began, those balances will still appear. However, you are not required to make any new payments between November 2025 and April 2026.

- You may see one month of arrears because the November payment was billed before the moratorium took effect. This will be corrected, and your account updated by the end of the six-month period. Your status letters and account records will also reflect your correct moratorium status.